- NASDAQ exchange sent Mullen notice of delisting.

- The delisting of MULN could happen as soon as September 15.

- Mullen is attempting to appeal the delisting decision and gain six months to comply.

- Failing to maintain the MULN share price above $1 is the reason for the delisting.

Mullen Automotive (MULN) stock has gained 2.2% to $0.4340 at Friday’s open. Part of the reason appears to be encouragement that Mullen management is fighting back against NASDAQ’s delisting announcement by attempting to appeal the decision.

The NASDAQ Composite is up 0.3% at the start of Friday’s session despite NASDAQ 100 futures trending lower in the premarket.

Mullen stock news: Michery attempts to gain NASDAQ extension

Mullen management announced on Thursday that they had appealed the delisting decision to the Nasdaq Listing Qualifications Panel. The electric vehicle maker stated that they may obtain as much as 180 days to bring MULN’s share price back into compliance.

All the way back in the spring time, the NASDAQ exchange had given Mullen six months to comply with the guidelines that require listed companies to keep their share price above the $1.00 mark. Instead of immediately complying, management led by CEO David Michery diluted the stock by about 10X in order to raise more than $200 million for Mullen’s production ramp-up.

With the MULN stock price trade down near $0.11, in early August the board of directors gave CEO David Michery the authority to perform the stock’s second reverse stock split of the year. This action gave each shareholder one share for every nine shares held previously.

This moved the share price back to $1.00 in time to meet the NASDAQ requirement that MULN trade above the threshold for 10 consecutive sessions prior to September 5. Why Michery did not perform a 1-for-20 reverse split to be on the safe side is anyone’s guess. The chief executive even admitted at the time that his lawyers and executives wanted him to go for a 1-for-50 ratio.

In May of this year, the company had already completed a 1-for-25 reverse split to raise its share price value. That reversal pushed the share price from $0.06 to about $1.50.

The NASDAQ Listing Qualifications Panel “has broad discretionary public interest authority, which includes the discretion to grant the Company up to an additional 180 calendar days from Sept. 5, 2023, to regain compliance,” a Mullen spokesperson said in a statement. “The Panel can also exercise that authority to apply additional or more stringent criteria for the continued listing of the Company’s common stock or suspend or delist securities. Ultimately, there is no guarantee that the Panel will grant an extension of the compliance period.”

Penny stocks FAQs

Originally, penny stocks were any stock that traded for less than $1, i.e. pennies. The Securities & Exchange Commission has since altered the definition to include any stock that trades for less than $5. Penny stocks are typically associated with small companies that have either experienced poor results, sending their share price down, or with companies who dilute their share price by issuing lots of shares over time in order to fund operations or acquisitions.

Some penny stocks trade on respected exchanges, such as the NASDAQ or the NYSE. Examples of these are Mullen Automotive (MULN) and Bark (BARK). Those exchanges have requirements though. For the NYSE, listed stocks must have 1.1 million publicly traded shares outstanding with a market value of at least $40 million. The NASDAQ requires a share price minimum of $4, a minimum of 1.25 million shares and a market cap of $45 million. Most penny stocks, however, trade on the OTC (over-the-counter) market. This may mean the OTC Bulletin Board or the privately-owned OTC Markets Group.

Quite often the sharpest movers on any normal trading day are found among penny stocks. This is because non-penny stocks tend to have more liquidity, and the market is more certain about larger companies’ long-term values. Penny stocks are illiquid, meaning there is little supply available if an announcement drives more buying demand into a particular stock. There are no market makers that hold large amounts of penny stocks just to dispense them at a slightly higher price point. Additionally, most of these penny stocks suffer from a news desert where few market players know anything relevant about them. This is why a small biopharma company can issue news about a successful drug trial and immediately rocket 500% higher, with no analysts on Wall Street covering it.

Typically, the answer is “No”. Penny stocks are more risky than higher-priced stocks on average. Penny stock investors have a higher chance of losing their capital by investing in weaker companies. There is a reason why they are penny stocks in the first place, which is that largely the mainstream market is not interested in investing in them. Two groups of investors tend to focus on penny stocks, however. The first group are day traders, who know that the lack of liquidity in penny stocks could lead to extremely large swings over a short time period. The other group is made up of investors who like the fact that these stocks are disregarded. This allows these investors to gain an advantage by benefiting from upcoming announcements, because the larger market is not paying attention.

Mullen stock forecast

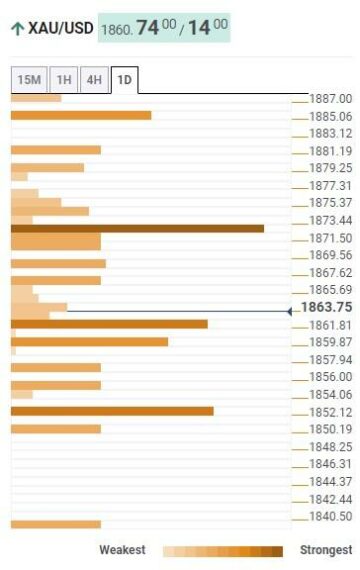

Mullen stock is at the very least holding steady above $0.39. That was the price where MULN discovered support on August 23. There is no reason to think that the share price will recover since it has mostly been in a downtrend for the past five years.

However, expect the share price to increase unnaturally if management is once again given an extension by NASDAQ’s committee. Michery will certainly use it to perform another reverse split.

MULN daily chart

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.fxstreet.com/news/mullen-automotive-stock-news-ceo-david-michery-attempts-to-stall-nasdaq-for-time-202309081304

- :has

- :is

- :not

- :where

- $UP

- 06

- 1

- 10

- 100

- 11

- 15%

- 180

- 2%

- 2023

- 23

- 25

- 39

- 50

- a

- About

- above

- acquisitions

- Action

- Additional

- Additionally

- admitted

- ADvantage

- After

- again

- against

- allows

- already

- also

- altered

- among

- amounts

- an

- Analysts

- and

- Animate

- announced

- Announcement

- Announcements

- Another

- answer

- any

- anything

- appeal

- Apply

- ARE

- AS

- associated

- At

- attempting

- Attempts

- attention

- AUGUST

- authority

- automotive

- available

- average

- back

- BE

- because

- been

- benefiting

- biopharma

- board

- board of directors

- bring

- broad

- bulletin

- Buying

- by

- CAN

- cap

- capital

- ceo

- certain

- certainly

- Chance

- chief

- Chief Executive

- commission

- committee

- Common

- Companies

- company

- Company’s

- Completed

- compliance

- comply

- complying

- consecutive

- content

- continued

- could

- covering

- criteria

- daily

- David

- day

- Days

- decision

- definition

- DELISTING

- Demand

- DESERT

- Despite

- DID

- diluted

- Directors

- discovered

- discretion

- discretionary

- down

- drives

- drug

- e

- each

- Early

- either

- Electric

- electric vehicle

- ends

- Ether (ETH)

- Even

- Every

- examples

- exchange

- Exchange Commission

- Exchanges

- executive

- executives

- Exercise

- expanded

- expect

- experienced

- extension

- extremely

- fact

- FAQ

- few

- fight

- fighting

- fights

- First

- five

- Focus

- For

- found

- Friday

- from

- fund

- Futures

- Gain

- gained

- gave

- given

- Go

- grant

- Group

- Group’s

- guarantee

- guidelines

- had

- happen

- Have

- Held

- higher

- him

- his

- hold

- holding

- However

- HTTPS

- i

- if

- immediately

- in

- include

- includes

- Increase

- instead

- interest

- interested

- into

- investing

- Investors

- issue

- issuing

- IT

- ITS

- jpg

- just

- Keep

- Know

- Lack

- large

- largely

- larger

- Lawyers

- lead

- least

- Led

- less

- like

- Liquidity

- Listed

- listing

- little

- long-term

- losing

- lower

- made

- Mainstream

- maintain

- maker

- Makers

- management

- mark

- Market

- Market Cap

- market makers

- market value

- Markets

- May..

- mean

- meaning

- Meet

- million

- minimum

- module

- months

- more

- most

- mostly

- moved

- Movers

- much

- mullen

- must

- Nasdaq

- Nasdaq 100

- Nasdaq Listing

- Near

- news

- no

- normal

- Notice..

- NYSE

- obtain

- of

- often

- on

- once

- ONE

- open

- Operations

- or

- order

- OTC

- Other

- outstanding

- over

- over-the-counter

- panel

- part

- particular

- past

- paying

- Penny stocks

- perform

- period

- Place

- plato

- Plato Data Intelligence

- PlatoData

- players

- Point

- poor

- previously

- price

- Price Value

- Prior

- Production

- public

- publicly

- pushed

- qualifications

- raise

- ratio

- reason

- Recover

- regain

- relevant

- require

- requirement

- Requirements

- requires

- respected

- Results

- Reversal

- reverse

- Risky

- rocket

- s

- safe

- Said

- Second

- Securities

- Securities & Exchange Commission

- sending

- sent

- sept

- September

- session

- sessions

- Share

- shareholder

- Shares

- Sharpest

- Short

- side

- since

- SIX

- Six months

- small

- Soon

- split

- spokesperson

- spring

- start

- starts

- stated

- Statement

- steady

- stock

- Stocks

- street

- successful

- such

- supply

- support

- Suspend

- Swings

- than

- that

- The

- their

- Them

- There.

- These

- they

- Think

- this

- this year

- those

- though?

- threshold

- thursday

- time

- to

- trade

- traded

- Traders

- trades

- Trading

- trending

- trial

- two

- typically

- Ultimately

- upcoming

- use

- value

- Values

- vehicle

- very

- Wall

- Wall Street

- wanted

- was

- Way..

- were

- which

- WHO

- why

- will

- with

- year

- years

- zephyrnet