The International Sustainability Standards Board (ISSB) has published its first two finalized standards, the first ever set of global reporting standards for ESG investors. The standards pave the way for companies to report on and disclose their climate and sustainability.

The standards are designed to be the foundation for a uniform and comprehensive global baseline of sustainability disclosures that investors have long desired. They mark the culmination of an 18-months long work.

The New Era of ESG Reporting

The standards consist of two separate frameworks for climate and sustainability reporting. The framework for disclosing sustainability-related financial information is known as IFRS S1 while IFRS S2 is for climate information.

Together, they usher in a new era of ESG – environmental, social and governance – reporting and disclosures in capital markets.

ESG became the banner for investors and served as their measuring tool in comparing companies. The term became the household name in the capital markets around the world, until a huge number of financial products and assets were labeled with ESG.

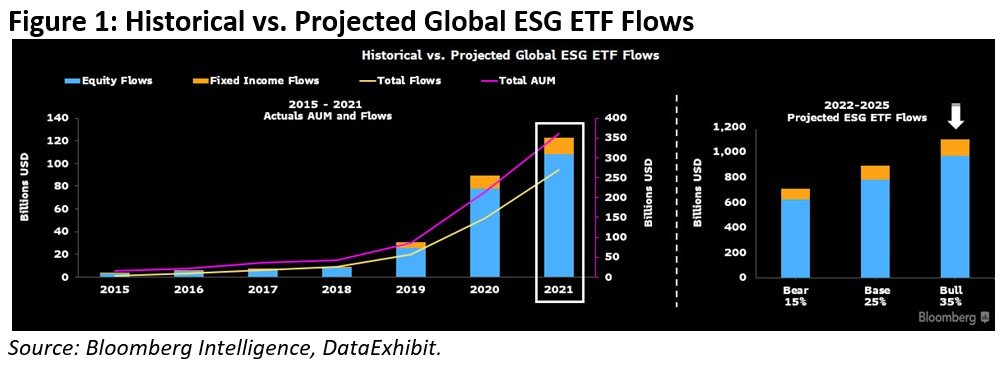

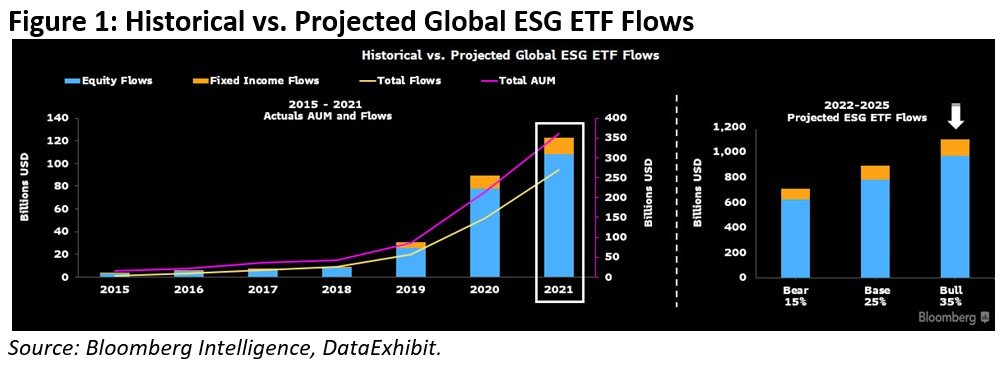

Bloomberg estimated that global ESG will surpass $41 trillion assets in 2022 and $50 trillion by 2025.

Apparently, ESG turned into a multi-trillion dollar business. But it was plagued with the issue of greenwashing or the mislabeling of ESG products. It’s the biggest concern, both for companies and more so for the investors.

And so, the ISSB aims to address this issue and finally publish the long-awaited ESG reporting standards.

The ISSB frameworks will affect what information companies include in their financial reports, prompting them to reflect ESG risks. Also, they’re not new but build on the previous works of existing standards and frameworks, including the following:

- Climate Disclosure Standards Board (CDSB),

- Task Force on Climate-related Financial Disclosures (TCFD),

- Value Reporting Foundation’s Integrated Reporting Framework, and

- Industry-based guidance from the Sustainability Accounting Standards Board (SASB).

More importantly, the ISSB Standards will ensure that companies provide ESG information alongside their financial statements, within the same reporting documents.

And for the first time, they created a common language for companies to disclose the climate-related risks and opportunities of their prospects.

ISSB Global Baseline for Sustainability Reporting

The lack of a global baseline ESG reporting framework made ESG investing confusing to investors. But with the new standards, ISSB’s vice-chair, Sue Lloyd, said that:

“Investors can be confident that, when they compare companies, they’re doing that on a like-by-like basis when they’re making their investment decisions.”

Under the ISSB climate standards (IFRS S2), companies need to:

- Determine their GHG emissions, which include all sources – Scopes 1, 2, and 3 – according to the Greenhouse Gas Protocol unless called to use other measures.

- Disclose the amount and percent of assets or activities prone to climate-related transition and risks.

- Report on how much capital expenditure they spend on climate-related risks and opportunities.

- Disclose whether or not they use internal carbon pricing and explain how.

- Report on climate-related targets.

Under the ISSB sustainability standards (IFRS S1), companies have to:

- Report information significant to financial prospects that may affect their investment decisions.

- Discuss how they will identify and monitor sustainability-related risks.

- Explain governance processes to track sustainability risks.

The new ISSB Standards are also based on the concepts that underpin the IFRS Accounting Standards, which 140 jurisdictions require. The standards are applicable worldwide, establishing a truly global baseline.

While the European Union has started their own standard-setting activities, the US Securities and Exchange Commission is still working on getting businesses to disclose their carbon emissions. The SEC requires companies to report on their absolute carbon emissions, including scope 3.

The Next Steps: Scope 3 Emissions

In finalizing the ESG reporting standards, over 1,400 comment letters were considered. And one major feedback on climate reporting is on Scope 3, which is challenging for most companies.

Corporations need to map their entire value chain to report on their emissions. To address this concern, the ISSB gave companies one more year to report on their Scope 3 information. They also provided other support and guidance in measuring and reporting Scope 3.

Companies can start applying the final version of the ISSB reporting standards next year. That means the first reports using the frameworks will be available to investors in 2025.

Companies can also focus on climate reporting first and disclose sustainability in the next year while countries can decide if they’ll make ISSB standards mandatory.

Ultimately, the global standards will help improve trust and confidence in companies’ climate and sustainability disclosures to inform investment decisions.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://carboncredits.com/issb-first-global-climate-and-sustainability-esg-reporting-standards/

- :has

- :is

- :not

- 1

- 2022

- 2025

- a

- Absolute

- According

- Accounting

- activities

- address

- affect

- aims

- All

- alongside

- also

- amount

- an

- and

- applicable

- Applying

- ARE

- around

- AS

- asset

- Assets

- available

- banner

- based

- Baseline

- basis

- BE

- became

- Biggest

- Bloomberg

- board

- both

- build

- business

- businesses

- but

- by

- called

- CAN

- capital

- Capital Markets

- carbon

- carbon emissions

- chain

- challenging

- Climate

- comment

- Common

- Companies

- compare

- comparing

- comprehensive

- concepts

- Concern

- confidence

- confident

- confusing

- considered

- countries

- created

- data

- decide

- decisions

- designed

- desired

- Disclose

- Disclosing

- disclosure

- Disclosures

- documents

- doing

- Dollar

- Emissions

- ensure

- Entire

- environmental

- Era

- ESG

- establishing

- estimated

- European

- european union

- EVER

- exchange

- existing

- Explain

- feedback

- final

- finalized

- Finally

- financial

- financial information

- financial products

- First

- first time

- flow

- Focus

- following

- For

- For Investors

- Force

- Foundation

- Framework

- frameworks

- from

- GAS

- gave

- getting

- GHG

- GHG emissions

- Global

- governance

- greenhouse gas

- guidance

- Have

- help

- household

- How

- http

- HTTPS

- huge

- identify

- if

- ifrs

- improve

- in

- include

- Including

- inform

- information

- integrated

- internal

- International

- into

- investment

- Investors

- issue

- IT

- ITS

- jpg

- jurisdictions

- Know

- known

- Lack

- language

- Long

- long-awaited

- made

- major

- make

- Making

- mandatory

- map

- mark

- Markets

- max-width

- May..

- means

- measures

- measuring

- Monitor

- more

- most

- much

- must

- name

- Need

- New

- next

- number

- of

- on

- ONE

- opportunities

- or

- Other

- out

- over

- own

- pave

- percent

- plagued

- plato

- Plato Data Intelligence

- PlatoData

- previous

- pricing

- processes

- Products

- prospects

- protocol

- provide

- provided

- publish

- published

- reflect

- report

- Reporting

- Reports

- require

- requires

- risks

- Said

- same

- scope

- SEC

- Securities

- separate

- set

- significant

- So

- Social

- Sources

- spend

- standards

- start

- started

- statements

- Steps

- Still

- sue

- support

- surpass

- Sustainability

- targets

- term

- that

- The

- The Capital

- the world

- their

- Them

- they

- this

- time

- to

- tool

- track

- transition

- Trillion

- truly

- Trust

- Turned

- two

- union

- until

- use

- using

- value

- version

- W3

- was

- Way..

- webp

- were

- What

- when

- whether

- which

- while

- will

- with

- within

- Work

- working

- works

- world

- worldwide

- year

- zephyrnet